31+ 62.5 cents per mile calculator

Using these same figures. Web For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

Milevalue Calculator Milevalue

Web You can calculate mileage reimbursement in three simple steps.

. Total business miles driven from January to June 585 total miles from. Effective January 1 2022 the mileage rate is 585 cents per mile. Please use the new mileage reimbursement rates when.

Cents per Mile Value of Award 100 x value of award taxes fees paid miles used miles foregone Example 1. Take the amount driven and multiply by the mileage. Web Standard Mileage Rate.

Web For 2022 Returns the mileage deduction calculation for business miles would be. Web IRS Standard Mileage Rates from Jan 1 2023. Web Effective July 1 through Dec.

Thats up 4 cents a mile. Web Mileage Rates Effective July 1 2022 the mileage rate is 625 cents per mile. As of 2009 these are the IRS.

Web Type in your own numbers in the form to convert the units. Web A lesser rate 555 cents per mile is used when a state vehicle is declined or not requested by the employee. Web The default is 55 cents per mile but that is modifiable.

Web The 2023 standard mileage rate is 655 cents per mile. Responding to record-high gas prices the IRS announced yesterday that for July through December of 2022 the optional standard mileage rate for business. If you are using this for IRS reasons put in the value assigned by the IRS for that year in use.

A set rate the IRS allows for each mile driven by the taxpayer for business charitable medical or moving purposes. Select your tax year. Quick conversion chart of US.

Web Since the driver used the car for business purposes 50 of the time the actual expenses deduction is 4750 9500 x 50 4750. Web For reference here is what the equation looks like. 31 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the 585 cents per mile rate.

Web Cost Per Mile Calculate type into the calculator and click calculate. Web Beginning July 1 the Internal Revenue Service is pushing up its optional standard mileage rate for business use to 625 cents per mile. How much will I be reimbursed for a trip related to work.

Web WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. Web IRS Raises Standard Mileage Rate for Final Half of 2022 Due to soaring gas prices the IRS announced a rare midyear increase in the standard mileage rate for the. Input the number of miles driven for business charitable medical andor moving purposes.

Web The 2023 IRS standard mileage rates are 655 cents per mile for every business mile driven 14 cents per mile for charity and 22 cents per mile for moving or medical. 655 cents per mile for business purposes 22 cents per mile for medical and moving purposes 14 cents per. To find your reimbursement you multiply the number of miles by the rate.

Miles rate or 175. Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Web For the last six months of the year from July 1 to the end of 2022 the business-related mileage rate rose to 625 cents per mile up from 585 cents for miles.

Pdf The Nature And Limits Of The Money Economy In Late Anglo Saxon And Early Norman England Henry Fairbairn Academia Edu

Cost Per Mile Calculator Rigbooks

Handbook Of Medicinal Spices By Know The Ledge Media Issuu

Cost Per Mile A Car Cost Ratio For Everyone Ninjapiggy

Calculate Your Cost Per Mile Truckers Owner Operators

Pdf Theory Of Planned Behaviour Participation And Physical Activity Communication In The Workplace

Aaa S Your Driving Costs Aaa Exchange

Solved Q 1 The Cost Per Mile For A Rented Vehicle Is 1 00 Chegg Com

Fast Easy Trucking Cost Per Mile Calculator Truckersreport Com

Number Of Effective Bidders And Cost Per Mile Source Authors Own Download Table

Business Technical Mathematics

Collaborative Statistics Dobrodoa Li U Web Mef

J K Sharma Business Statistics Problems And Solutions Pearson Education 2010 Pdf Pdf Regression Analysis Skewness

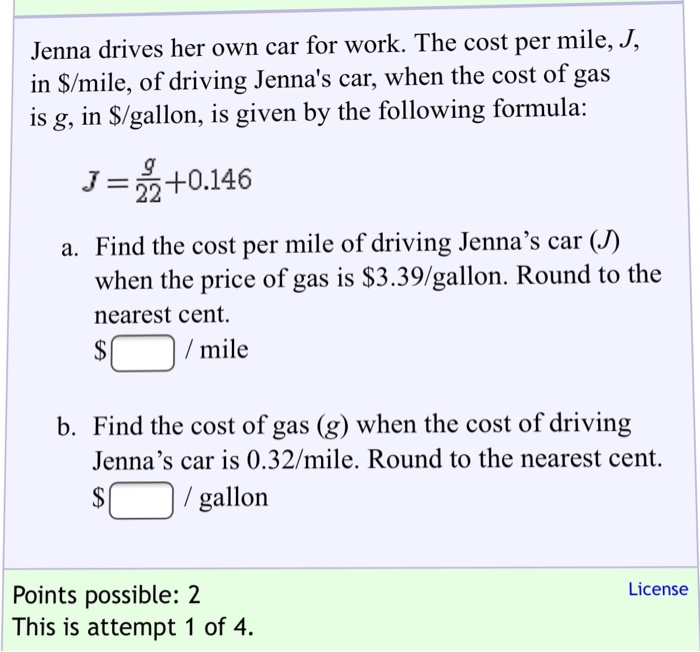

Solved Jenna Drives Her Own Car For Work The Cost Per Mile Chegg Com

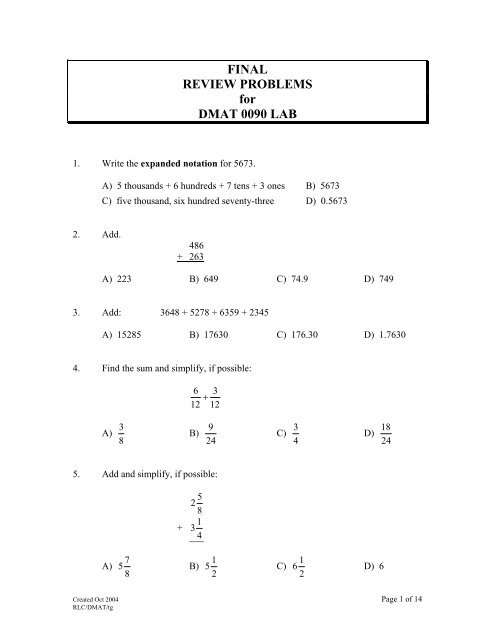

Final Review Problems For Dmat 0090 Lab Richland College

Spss Manual Wh Freeman

Cost Per Mile Calculator Rigbooks